Financial Risk Manager Introduction

Contents

The Financial Risk Manager (FRM) Certification is the true standard for educational excellence in risk management and a gateway to achieving new career heights in the risk profession.

Key Concepts

Interest Rates

Required Rate of Return

- Required rate of return / 要求回报率 / yield

- Influenced by the

supply and demand of fundsin the market. - Represents the return that investors and savers need to convince them to willingly lend their money.

- Typically associated with a specific investment.

- Example: If I deposit my money in a bank, what would the interest rate be?

- In this case:

- Interest rate = Required Rate of Return = Real Risk-free Return (真实无风险收益率) + Inflation Rate (通货膨胀收益率)

- Breaking down the required rate of return:

- Nominal risk-free rate = real risk-free rate + expected inflation rate.

- Required interest rate on a security = nominal risk-free rate + default risk premium + liquidity risk premium + maturity risk premium.

Discount Rate

- Discount rate / 折现率

- This is the interest rate used to

discount future payments. - It is often used interchangeably with the term “interest rate”.

- Depending on the situation, “interest rate” can have different names:

- Example 1: I deposit $100 in a bank for one year and receive a 10% interest rate. After one year, I have 110.

- In this scenario, the 10% interest rate is referred to as the 10% Required Rate of Return.

- Example 2: I want to have $10 after one year. If the interest rate is 10%, how much should I deposit in the bank? Using the formula (x+10)/(1+10%) = x, we find x = 100.

- In this scenario, the 10% interest rate is referred to as the 10% Discount Rate.

- Example 1: I deposit $100 in a bank for one year and receive a 10% interest rate. After one year, I have 110.

Opportunity Cost

- Opportunity cost / 机会成本

- This can be seen as a type of interest rate. It represents the value that investors give up when they choose a particular course of action.

Basic Calculation

Future Value (FV)

- Amount to which investment grows after one or more compounding periods

Present Value (PV)

Current value of some future cash flow

If interests are compounded m times per year, and

invest 1 year:If interests are compounded m times per year, and

invest n years:Where:

mis the compounding frequency;ris the nominal / quoted annual interest rate

Simple Interest

Simple Interest / 单利

Interest is compounded annually at 10% per annum

sequenceDiagram Note over Start Deposit: PV = 100$ Start Deposit->>First Year End: 10% Note over First Year End: 100+100*10% First Year End->>Second Year End: 10% Note over Second Year End: FV = 100+100*10%*2sequenceDiagram Note over Start Deposit: PV = 100$ Start Deposit->>First Year End: 10% Note over First Year End: 100+100*10% First Year End->>Second Year End: 10% Note over Second Year End: FV = 100+100*10%*2

Compound Interest

Compound Interest / 利滚利

Interest is compounded annually at 10% per annum

sequenceDiagram Note over Start Deposit: PV = 100$ Start Deposit->>First Year End: 10% Note over First Year End: 100*(1+10%) First Year End->>Second Year End: 10% Note over Second Year End: FV = 100*(1+10%)^2sequenceDiagram Note over Start Deposit: PV = 100$ Start Deposit->>First Year End: 10% Note over First Year End: 100*(1+10%) First Year End->>Second Year End: 10% Note over Second Year End: FV = 100*(1+10%)^2

Continuously Compounding:

- Interest is compounded

mtimes per year at an annual rate ofr%, then afternyears

Annuity

- Annuity / 年金

- Annuity is a stream of

equal cash flowsthat occurs atequal intervalsover a given period - Classify:

- Annuity due - 先付年金(年初支付)

- Ordinary annuity - 后付年金(年末支付)

Framework of FRM Program

Outline

PART Ⅰ

- Foundations of Risk Management 风险管理基础(20%)

- 基础知识,学完其他三门基本掌握该部分知识

- Quantitative Analysis 数量分析(20%)

- 金融:在不确定的情况下,资产的跨期配置

- 概率论和统计学

- Financial Markets and Products 金融市场与金融产品(30%)⭐

- Part Ⅰ 3/4 是二级

市场分险的基础 - Part Ⅰ 3/4 最好放在一起学习

- Part Ⅰ 3/4 是二级

- Valuation and Risk Models 估值与风险建模(30%)⭐

PART Ⅱ

- Market Risk Measurement and Management 市场分险测量与管理(25%)

- Credit Risk Measurement and Management 信用分险测量与管理(25%)

- Operational and Integrated Risk Management 操作及综合风险管理(25%)

- Risk Management and Investment Management 投资风险管理(15%)

- Current Issues in Financial Markets 金融市场前沿话题(10%)

PART Ⅰ

Foundations of Risk Management

- Risk Management (Best practice)⭐

- Risk management and Corporate Governance Perspective

- Implementing Risk Appetite Frameworks

- Principles for Effective Data Aggregation and Risk Reporting

- Risk Management Failures

- Capital Asset Pricing Model (Theory)⭐⭐⭐

- The Standard Capital Asset Pricing Model

- Arbitrage Pricing Theory and Multifactor Models of Risk and Return

- Applying the CAPM to Performance Measurement

- Information Risk and Data Quality Management

- Financial Disasters⭐⭐

- The Credit Crisis of 2007

- GARP Code of Conduct

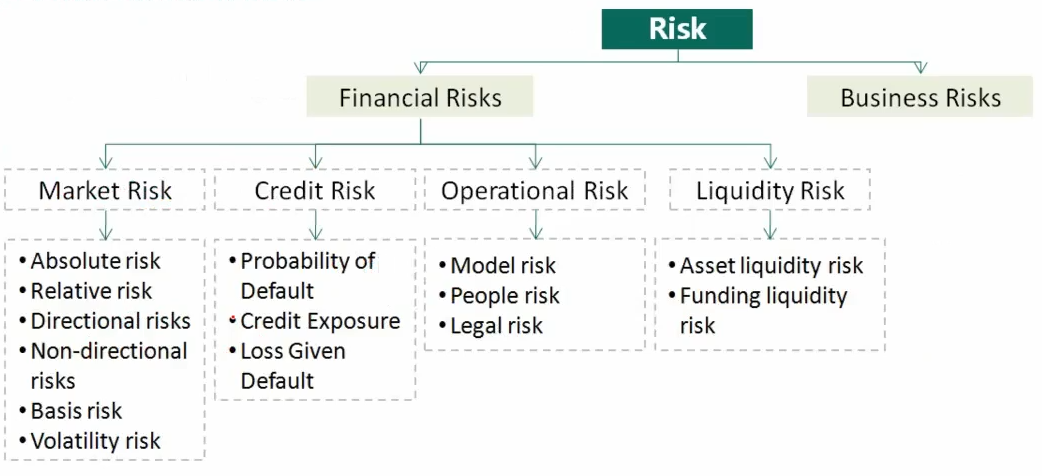

Risk

- Definition of Risk

- Risk is defined as the unexpected variability of asset prices and/or earnings. It is a mix of danger and opportunity

- Sources of Risk

Business riskis the risk that a firm is subjected to during daily operations and includes the risks that result from business decisions and the business environmentFinancial risksare the results of a firm’s financial market activities

Quantitative Analysis

- Probability

- Basic Statistics

- Distributions

- Hypothesis Tests and Confidence Intervals

- Linear Regression

- Linear Regression with One Regressor

- Linear Regression with Multiple Regressors

- Simulation Modeling⭐

- Estimating Volatilities and Correlations⭐

- Correlation and Copulas

Financial Markets and Products

- Derivative Contract

- Structure and mechanics of OTC and exchange markets

- Structure, mechanics, and valuation of Derivative Contracts

- Forwards, Futures and Swaps

- Options

- Hedging wit derivatives

- Financial Product (Fixed Income)

- Interest rates and measures of interest rate sensitivity

- Foreign exchange risk

- Corporate bonds

- Mortgage-backed securities

- Rating agencies

Valuation and Risk Models

- Valuation

- Option valuation

- Fixed income valuation

- Risk Models

- Value-at-Risk (VaR)

- Expected shortfall (ES)

- Stress testing and scenario analysis

- Risk Management

- Hedging

- Country and sovereign risk models and management

- External and internal credit ratings

- Expected and unexpected losses

- Operational risk